More households benefiting from family allowances than taxable households

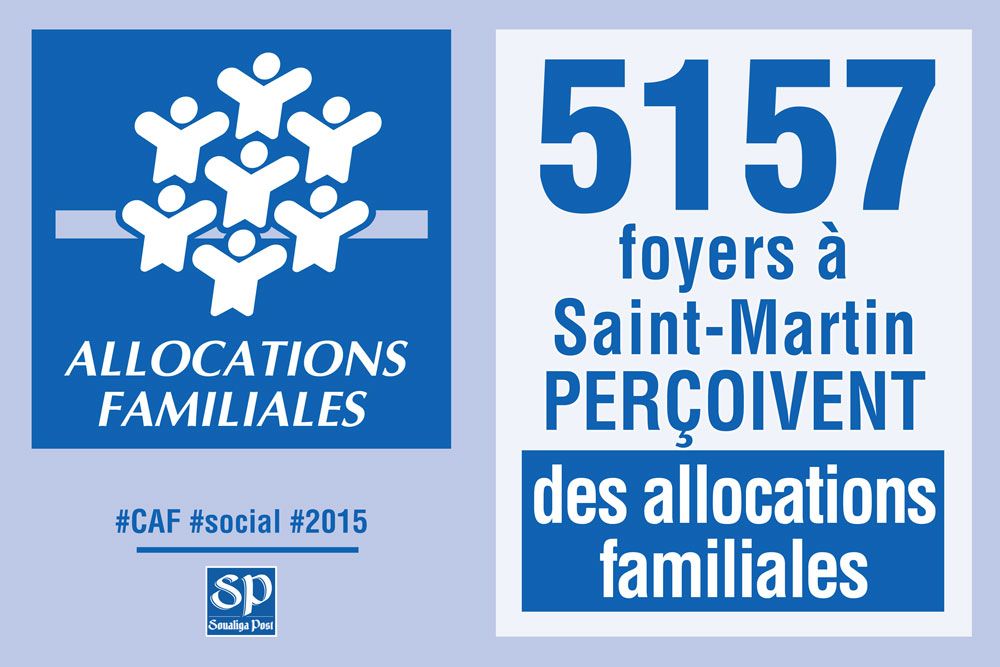

In 2015, 5157 households* were entitled to family allowances in Saint-Martin (a household can include several people). That’s 903 households more than the number of taxable households, meaning those who pay taxes on the French side. That’s a huge difference but this isn’t specific to Saint-Martin.

The situation is the same in French Guyana, Reunion and Mayotte: the number of people receiving family allowances is higher than those who pay taxes. The gap is respectively 8,051, 25,415 and 13,014. Only in Martinique are there many more taxable households than those who receive allowances (62,700 against 45,760). In Guadeloupe, it’s almost the same: 58,820 taxable households and 53,900 beneficiaries of allowances.

However, if we compare the number of households receiving family allowances to the number of tax units, Saint-Martin comes in first place among the overseas territories along with Guyana. Indeed, household beneficiaries represent 33% of the tax units here and 31.5% in Guyana. The proportion is less than 12 points - or even 15 - in the West Indies. In the Indian Ocean, it is less than five points.

However, things need to be put into perspective. A household that receives family allowances is not necessarily a household which is poor, without income, or even non-taxable. Indeed, a couple with two children and earning a total of 3,600 euros net per month (1800 € x 2) receives about 130 euros of family allowances per month and will not be taxable (according to the tax simulation calculator in Guadeloupe where the abatement is less interesting than in Saint-Martin). They are therefore included in these statistics. The same applies to a couple who earns 2 x 1900€ per month, receives allowances and pays taxes.

Finally, one must bear in mind that the number of households benefiting from family allowances has been decreasing in Saint-Martin since 2010 (- 2.8%).

*Source: CNAF.